Introduction

Buying a home is more than just a financial transaction; it is the realisation of a lifelong ambition and a powerful symbol of your success. However, that milestone comes wrapped in a complex layer of legalities, most notably the distinction between the Sale Agreement and the Sale Deed.

While these terms are often grouped in casual conversation, they represent two distinct pillars of a property transaction. Distinguishing between them is not just a matter of semantics; it is a vital step in protecting your investment. Understanding how these documents function ensures that your journey from “prospective buyer” to “legal owner” is seamless, transparent, and legally secure.

What is a Sale Agreement for Property?

A Sale Agreement is a legally binding contract that establishes the mutual intent of a buyer and seller to complete a property transaction under specific terms and conditions. Governed by the Indian Contract Act (1872) and the Transfer of Property Act (1882), it serves as a formal “promise to sell.”

Under Section 54 of the Transfer of Property Act, while this document creates a right to obtain another document (the Sale Deed), it does not, by itself, transfer the legal title or ownership of the property.

7 Essential Components of a Sale Agreement

To ensure a transparent transaction, a legally strong agreement must include the following details:

1. Identity of both buyer and seller

2. Property Description

3. Price and payment schedule

4. Possession date

5. Mutual obligations

6. Indemnity and dispute clause

7. Exit and penalty terms

Details of the Key Components of a Sale Deed ( With Additional Clauses)

A sale deed is one of the most critical legal documents in a property transaction. It captures all essential details of the sale and serves as conclusive evidence of ownership transfer from the seller to the buyer. The following elements ensure the sale deed is legally valid, transparent, and comprehensive:

-

Parties to the Transaction

The sale deed must clearly specify the identities of both parties involved—the seller (transferor) and the buyer (transferee). This includes their full names, ages, residential addresses, and contact details. Accurate identification helps establish legal standing and avoids future disputes.

-

Property Description

An exact and detailed description of the property is mandatory. This typically includes:

- Complete postal address

- Nature of the property (residential, commercial, agricultural, etc.)

- Boundaries and measurements

- Total area (in square feet or square metres)

- Survey number, plot number, or identification number

- A property schedule for precise identification

-

Sale Consideration

The sale deed must clearly mention the total agreed sale value of the property, along with:

- Advance amount paid, if any

- Mode of payment (cheque, demand draft, bank transfer, etc.)

- Payment structure or instalment details

- Acknowledgement or receipt of payments made

-

Payment Terms

This clause defines the payment framework, including:

- Whether payment is made as a lump sum or in instalments

- Timelines and due dates for payments

- Outstanding balance, if applicable

- Penalties or implications in case of delayed payment

-

Transfer of Title

The seller must declare lawful ownership and their right to sell the property. This section confirms that:

- The title is clear and marketable

- The property is free from disputes, claims, or third-party interests

- Ownership and title will pass to the buyer upon registration

-

Possession Clause

The deed should clearly state:

- The date on which possession will be handed over

- Whether possession is delivered at registration or at a later stage

- Assurance that all original and relevant documents will be transferred to the buyer

-

Encumbrances and Liabilities

This clause clarifies the encumbrance status of the property and should:

- Confirm the absence or existence of mortgages, loans, or legal charges

- Disclose any existing liabilities

- Be supported by an Encumbrance Certificate, where applicable

-

Indemnity Clause

To safeguard the buyer’s interests, the seller must:

- Assure a clear and undisputed title

- Confirm settlement of all statutory dues, such as property tax, utility bills, and maintenance charges

- Agree to indemnify the buyer against any future claims or losses arising from prior issues

-

Rights and Obligations

This section outlines:

- Rights vested in the buyer after the sale

- Any obligations that continue post-transfer

- Responsibilities of the seller until possession is handed over

-

Default Clause

The default clause specifies remedies and consequences if either party fails to fulfil their obligations, including:

- Penalties for non-payment or breach

- Legal remedies for non-transfer of title

- Refund or cancellation terms, if the transaction is terminated

-

Dispute Resolution

In case of disagreements, the sale deed must define:

- The agreed mode of dispute resolution (mediation, arbitration, or litigation)

- The jurisdiction under which disputes will be settled

-

Execution and Signatures

For legal validity, the sale deed must be:

- Signed by both the buyer and the seller

- Attested by a minimum of two witnesses

- Date and mention the place of execution

Legal Significance & Financing

A Sale Agreement is more than a record; it is a tool for accountability:

- Enforceability: Once signed, it can be used in court to demand “specific performance” if a party fails to honour the deal.

- Home Loans: Banks and financial institutions treat a registered Sale Agreement as a primary document for processing mortgage applications.

Registration and Stamp Duty

While some states view registration as optional for certain property types, registering the agreement at the Sub-Registrar’s Office on appropriately valued stamp paper significantly enhances its admissibility in court.

Sale Agreement vs. Sale Deed

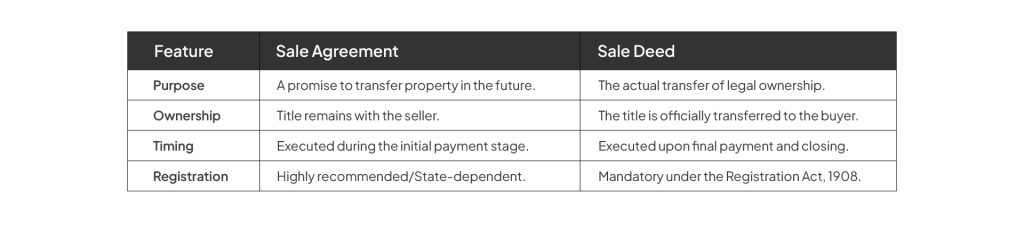

These two terms sound similar, but they actually serve very different purposes.

A Sale Agreement is the first step in the process. It’s a preliminary understanding between the buyer and the seller that clearly lays out the terms of the deal, like price, timelines, conditions, and responsibilities. Once signed, it becomes legally binding and protects both parties throughout the transaction.

A Sale Deed (also called a Conveyance Deed or Title Deed) is the final step. This document officially transfers ownership of the property from the seller to the buyer. Once the Sale Deed is executed and registered, the sale is complete—and it stands as the ultimate legal proof that the property now belongs to the buyer.

Pre-Signing Checklist for Buyers

Before committing to an agreement, check the following details:

- Title Verification: Confirm the seller has a “clear and marketable” title.

- Encumbrance Check: Ensure the property is free from undisclosed loans or legal disputes via an Encumbrance Certificate (EC).

- Review Clauses: Check the document thoroughly before you sign something that can cause regrets later.

- Legal Consultation: Have a real estate attorney review the draft to ensure compliance with local state laws.

Conclusion

The Sale Agreement acts as a legal shield. It locks in the price, prevents the seller from entertaining other offers, and provides a clear roadmap to the final Sale Deed. For any homebuyer, a well-drafted and registered agreement is the most effective way to safeguard a life-changing investment.

FAQs (Frequently Asked Questions)

- What is the difference between a Sale Deed and a Sale Agreement?

A Sale Agreement outlines the terms and conditions under which a property will be sold in the future. A Sale Deed, on the other hand, is the final legal document that transfers ownership of the property from the seller to the buyer. Registration of the Sale Deed serves as official government recognition of this transfer.

- What is an Apartment Deed?

An Apartment Deed is a legal document that grants ownership of a specific apartment within a multi-unit building. It clearly defines the apartment’s boundaries and sets out the rights, responsibilities, and conditions associated with ownership of that individual unit.

- Can an Agreement for Sale be terminated?

Yes, an Agreement for Sale can be terminated either by mutual consent of both parties or due to a breach of the terms stated in the agreement. The conditions and consequences of termination are usually specified within the agreement itself.

- Can a Sale Deed be terminated?

A Sale Deed is a final and legally binding document that completes the property transaction. Once executed and registered, it cannot usually be terminated. Any disputes thereafter must be resolved through legal proceedings or mutual settlement between the parties.

- What are the important elements of a Sale Deed?

A Sale Deed primarily includes the transfer of title, through which the seller legally transfers ownership rights to the buyer and relinquishes all claims to the property. It also contains details of the parties involved and a clear description of the property being transferred.

- Is a Sale Agreement mandatory?

In India, a Sale Agreement is not legally mandatory for property transactions. However, under the Registration Act, 1908, registration is compulsory for transactions involving immovable property valued at more than ₹100. Since you can barely buy a square inch of land for ₹100 today, this effectively means every property sale in India requires a registered document.

Read our Latest Blogs

Understanding Floor Space Index (FSI): Definition, Calculation, and Significance

Real Estate Basics

- January 27, 2026

- 22 min read

Satellite Town Ring Road (STRR) Bangalore: Route, Benefits, Latest Updates & Real Estate Impact

Buying & Investing Insights

- January 5, 2026

- 11 min read

Chikka Tirupathi-Sarjapur: Price Trends & Investment Guide 2026

Investment Guide

- December 22, 2025

- 16 min read

Explore Projects

Independent 4 & 5 BHK Villas

starts @ 4 Cr

Sarjapur’s Exclusive 3 BHK Community

starts @ 1.8 Cr

Multi-Gen 2 & 3 BHK Homes

Starts @ 1.87 Cr

Refer & Earn Up to 51%

Invite your friends to explore Modern Spaaces and earn up to 5% of the home value they buy.

Find your Dream Home. Let's talk

Tell us a bit about what you're looking for. One of us will get back to you!